Due to the large processing capacity of factories, they are always in a state of “hungry” for raw materials, leading to competition to buy input materials, so the price of raw cashew increases.

Raw cashew nuts in husk – Photo: IT

According to statistics of the General Department of Customs, cashew exports in the first half of March 2021 reached 19,767 tons, worth 114,628,579 million USD. Cumulative from January 1 to March 15, it reached 86,851 tons, with a turnover of 508,495,552 million USD. Compared to the same period in 2020, cashew exports increased by 25.36% in volume and 3.65% in turnover.

EXPORTS INCREASE IN VOLUME BUT DECREASE IN VALUE

Mr. Ta Quang Huyen, Vice Chairman of the Vietnam Cashew Association (VINACAS), General Director of Hoang Son 1 Company, said that all Vietnam’s cashew export markets consumed well and the consumption increased by 8 – 10%.

In the first quarter of 2021, the cashew industry is still exporting well, increasing strongly in volume but the export price is lower than in the first quarter of 2020, so the increase in export turnover is not commensurate with the increase in volume. The low export price is the result of the Covid-19 epidemic that has made the price go down since last year, the export price in the first quarter of this year is the successor to the price of last year and it takes time to prosper.

“The export price of cashew kernels has not increased, but the import price of raw cashew nuts has increased because many factories lack raw materials. In Vietnam, the number of cashew processing factories has increased a lot, inluding FDI enterprises, so they should divide the source of raw materials, causing the lack of raw cashews. In order to have enough raw materials, the factories competed to buy, make the the price of raw cashew to increase.

In fact, this is the lack of raw materials for the processing plant’s capacity, and also the lack of instability because the cashew processing capacity of factories in Vietnam is growing hot, while the world’s cashew consumption is still in balance.

That is also the current problem of Vietnam’s cashew industry. Due to the large processing capacity of cashew factories, they are always in a state of “hungry” for raw materials, so it leads to the fact that factories compete to buy raw materials while cashew kernels are still sufficient to supply the market” Mr. Huyen shared.

According to VINACAS, the volume of imported raw cashew nuts in 2020 will reach 1.6 million tons, expected to increase to 1.8 million tons in 2021. The supply of cashew nuts in 2021 is quite stable.

The total area of cashew trees in Vietnam in 2021 will reach 297,000 hectares, equal to 99.7% compared to 2020. Currently, farmers are in the peak season of harvesting cashew nuts, expected to end at the end of April with the production of 350,000 tons. The yield of this year’s cashew crop is not good due to the unseasonal rains causing a lot of fruit rot, reducing yield by 15-20%.

According to the Import and Export Department (Ministry of Industry and Trade), in early March 2021, the price of raw cashew nuts in Vietnam was generally quite stable. In Binh Phuoc province, the price of raw cashew nuts is 33,000 VND/kg; in Dong Nai province at 28,000 VND/kg.

INTENSIVE PROCESSING TO IMPROVE VALUE

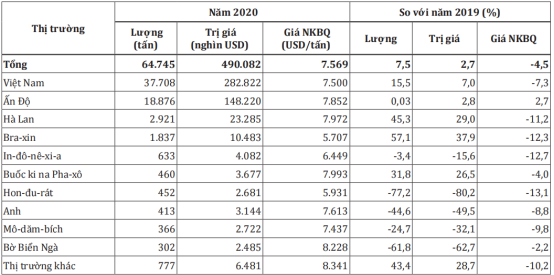

Germany is one of the key markets for Vietnamese cashews. According to statistics from the International Trade Center, the total cashew imports of Germany in 2020 reached 64.7 thousand tons, worth $490 million, increased by 7.5% in volume and 2.7% in value compared to 2019.

In the global cashew nut value chain, Vietnam mainly still exports low-value processed cashew kernels, about 10 USD/kg.

While the finished cashew kernel reaches consumers in other countries worth 30 USD/kg. Thus, Vietnam only accounts for about 30% of the cashew industry value chain.

In which, Germany’s cashew imports from Vietnam in 2020 reached 37.7 thousand tons, worth 282.82 million USD, increased by 15.5% in volume and 7.0% in value compared to 2019. Vietnam’s cashew nut market share in Germany’s total imports accounted for 58.24% in 2020, higher than 54.18% in 2019.

In 2020, the average import price of cashew nuts in Germany reached 7,569USD/ton, decreased by 4.5% compared to 2019. In which, the average import price of cashews in Germany decreased for most of the main supplying markets, except India with an increase of 2.7%, to $7,852/ton. In 2020, Germany increased its imports of cashews from Vietnam, India, the Netherlands, and Brazil, but reduced imports from Indonesia, Honduras, and the UK.

Top 10 largest cashew supply markets to Germany in 2020

In 2021, the cashew industry aims to export 3.6 billion USD, an increase of 12.9% compared to 2020, and so far, Vietnam has exported cashew kernels to more than 90 countries and territories, accounting for about 80% of cashew kernels exported in the world.

However, in the global cashew nut value chain, Vietnam mainly still exports low-value processed cashew kernels, about 10 USD/kg, while the finished cashew kernel reaches consumers in other countries about 30 USD/kg. Thus, Vietnam only accounts for about 30% of the cashew industry value chain.

The biggest advantage of Vietnam’s cashew industry is the world’s most advanced processing technology produced by Vietnamese people. However, that is still not enough to overcome the above problems, the cashew industry needs a methodical strategy to increase the value of cashew nuts, switching from preliminary processing of cashew kernels and exporting semi-finished products to finished products, then go directly to supermarkets.