Robusta coffee forward price increased, the domestic market could not keep up. Our country’s exports reported a decrease: due to retention of goods or uncompetitive selling prices?

Domestic price not yet exceeded “threshold”

Now is the first month of the last quarter of the coffee crop year in Vietnam and the world, starting from the 1st day of October of this year to the 30th day of September of the next year. Just like at this time every year, there is not much coffee left in farmers. Therefore, the exchange of visible goods delivered from the buyer to the seller is quite limited. As normal, with this phenomenon, the domestic price should increase sharply.

But from yesterday until this morning, Saturday July 05th, 2014, the price of raw coffee in the Central Highlands provinces was only around 40.8 million VND/ton, not exceeding the important expectation of 41 million VND/ton. According to some agents and exporters, the reason why the price has not increased strongly is due to the large number of consignments finalized the selling price. This phenomenon has contributed to “staying” the domestic coffee price in the past few days, although it should have surpassed that level if compared with the increase in the same direction as the forward price.

The closing price of robusta coffee on the Ice Liffe futures floor in London on Thursday Jul. 03 rose even higher than the peak price of June 2014 of $2,034/ton to reach $2,068/ton, increased by $34/ton but was $174/ton higher than last month’s closing low of $1,894/ton on Jun. 10.

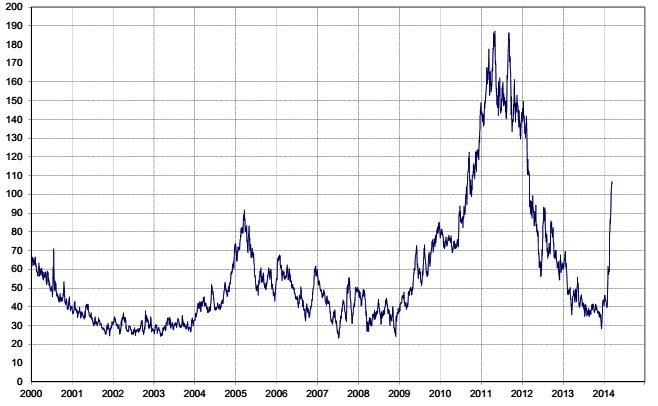

Late yesterday Jul. 04 or early this Saturday morning, although London robusta futures closed lower than $12, to only $2,056/ton, this level is still higher than the peak price of the whole month of June 2014. Therefore, the domestic price could not even surpass the “threhold”, before it could increase, it was pressured to decrease (see the chart above).

Exported coffee is paid with lower price

Another reason why the domestic price has not been able to rise to match the strength of the forward price is that the export price calculated on the basis of the difference with the listed price has decreased quite a lot. Robusta coffee grade 2.5% broken black was offered at the same price as listed on the London floor a few weeks ago, now exporters offer a price lowering $30/ton and importers ask to only “match” the price minus $60-65/ton below the London forward price.

“The reason we have to pay a minus 60-65 dollars/ton is because we can buy Brazilian robusta freely right now with a minus 30-40 dollars/ton. The difference between 20-30 dollars is not because of the quality, but because the freight from Brazil to the US is much cheaper than the one from Vietnam to there”, a Swiss importer with a representative office in Ho Chi Minh City said.

If the above statement is true, this is a concern for the robusta coffee market share of exporting countries of this product.

The General Department of Statistics estimated that our country’s coffee exports in June 2014 reached only 110,000 tons, down from 137,000 tons in May 2014.

Bad harvest but large volume sold

Although the rumor of a negative impact of drought earlier this year in Brazil causing a bad harvest in this country have not ended, and although it seems very busy with exciting activities at the 2014 World Cup, Brazil and neighboring Colombia still do not stop increasing their exports.

According to estimates by the Brazilian Ministry of Commerce, the country’s coffee exports in June 2014 reached 2.62 million bags (60 kg x bags), up 26% from 2.08 million bags in the same period last year. According to the National Coffee Federation of Colombia, in the past month, exports of this country also increased by 11.74% to 752,000 bags. In the first nine months of the crop year 2013/14, Colombian Arabica coffee exports are estimated at 8.27 million bags, up 30% over the same period last year.

Strong exports at low prices in the context of many constant rumors that the upcoming crop year will be a bad harvest make coffee traders concerned.

Indeed, strong exports have had a negative effect on forward prices. If the price of Robusta since the end of last month until now is increasingly stable, then the price of Arabica continues causing more frustration. If the closing price of Arabica futures on the New York Ice Exchange on June 25 reached a peak in June 2014 of 182.05 cents/pound (cts/lb); on July 3, it was only 171.80 cts/lb or $4,013 and $3,787/ton respectively, down $226/ton.

A bad harvest of Arabica: overturning the game?

The strange opposite movement of the two futures floors of Robusta and Arabica must confuse many analysts. As Rabobank, a professional and adept coffee sponsor and market analyst, has to say: the more you harvest, the more you see that how much people exaggerate about the “specific effect” of the drought on Brazilian coffee production. This is evident in the market: Arabica forward price have fallen and the difference between Arabica and Robusta is not much now.

Movement of the price gap between the two exchanges of Arabica and Robusta.

The world coffee market deals mainly with two types of coffee, Arabica and Robusta. Arabica determines the quality of a cup of coffee and accounts for about 60-65% of real transactions. It is said that when the difference (arbitrage) between Arabica and Robusta is larger, i.e. the price of Arabica is more expensive due to lack of goods: drought, for example; when this difference is smaller, that means Arabica is cheap. Based on this difference, roasters will decide to use this one or that one more for the purpose of reducing costs.

By the end of July 3, the difference of Arabica and Robusta was only $1,746/ton compared to April 23 was $2,575/ton, but in mid-2011, sometimes the difference was over $4,100/ton (please see the chart above). If the current trading price of Robusta is $2,000/ton, then Arabica is at $3,746/ton and on April 23, buyers have to pay $4,575 for each ton of Arabica coffee.